Archive for January 2009

GDP: Even worse than it looks

Jan 30th 2009

From Economist.com

America’s economy shrank sharply in the fourth quarter. There are few reasons for optimism

The original article appears here.

|

|

|

|

IT IS a measure of the prevailing gloom that the worst economic performance in 26 years could still be described as better than expected. Real gross domestic product fell at an annual rate of 3.8% in the fourth quarter, below the decline of 5% or more that many economists had anticipated.

However, there is precious little reason for optimism. Read the rest of this entry »

Blanchard roundtable: Pursue contingent policies

Posted by:

Categories:

A response to Olivier Blanchard’s guest Economics Focus. The original article is here.

This discussion can be followed in its entirety here.

UNCERTAINTY is a constant in economic life, but Olivier Blanchard notes that at present it is sufficiently pervasive as to be a major exogenous source of restraint on demand. He recommends policies that reduce uncertainty, as distinct from policies that simply boost aggregate demand.

Many of his policies, however, would take effect regardless of the state of the economy. It seems to me, by contrast, that the way to deal with uncertainty is through contingent policies that are triggered when a predetermined bad state of the economy is reached. Read the rest of this entry »

Lessons from Sweden’s “Bad bank”

AMERICA may be moving closer to creating a “bad bank” to absorb its banking system’s impaired assets. Would it work? No one knows, but everyone is looking to Sweden—which used that model in the early 1990s after its banks crumpled under the weight of bad real estate loans—for guidance.  I talked to Bo Lundgren, who was the minister in charge of taxation, financial markets, and sports (yes, sports) at the time of the bail-out, to learn more about which issues are likely to prove stickiest for America. What are the toughest challenges—the extent to which banks are nationalised, the relative importance of recapitalisation versus purchases of bad assets, or something else? What follows is based on our conversation. Read the rest of this entry »

I talked to Bo Lundgren, who was the minister in charge of taxation, financial markets, and sports (yes, sports) at the time of the bail-out, to learn more about which issues are likely to prove stickiest for America. What are the toughest challenges—the extent to which banks are nationalised, the relative importance of recapitalisation versus purchases of bad assets, or something else? What follows is based on our conversation. Read the rest of this entry »

The economics of “Good bank-bad bank”

Economics focus

The spectre of nationalisation

From The Economist print edition

There are ways for governments to revitalise banks without taking them over

|

|

|

|

IT IS generally easier to remove a kidney from a dead donor than a live one. When regulators in Scandinavia and America in the early 1990s started extracting the bad assets from their crisis-hit banking systems, it helped that the banks they dealt with were bust or in the government’s hands. Today, policymakers are trying to excise toxic assets from banks that are still, at least officially, private and viable. That is a much trickier proposition. Read the rest of this entry »

George Bush’s legacy

This was cowritten with my colleague, Washington Bureau Chief Adrian Wooldridge

The frat boy ships out

From The Economist print edition

Few people will mourn the departure of the 43rd president

HE LEAVES the White House as one of the least popular and most divisive presidents in American history. At home, his approval rating has been stuck in the 20s for months; abroad, George Bush has presided over the most catastrophic collapse in America’s reputation since the second world war. The American economy is in deep recession, brought on by a crisis that forced Mr Bush to preside over huge and unpopular bail-outs.

America is embroiled in two wars, one of which Mr Bush launched against the tide of world opinion. The Bush family name, once among the most illustrious in American political life, is now so tainted that Jeb, George’s younger brother, recently decided not to run for the Senate from Florida. A Bush relative describes family gatherings as “funeral wakes”.

Few people would have predicted this litany of disasters when Mr Bush ran for the presidency in 2000. Read the rest of this entry »

How to compute sovereign default probabilities

My article mentions invesetors’ estimates of the probability the U.S. will default based on spreads on credit default swaps. Some readers have asked how I computed the probabilities. What follows is a guide but should not be considered authoritative. Read the rest of this entry »

Awful jobs report but temper the pessimism

From Economist.com

Reasons to temper pessimism, but not to delay action in America

|

|

|

|

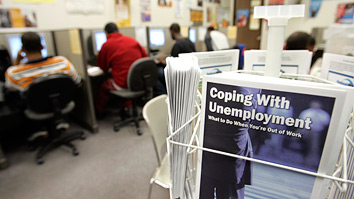

IF BARACK OBAMA grows tired of being president, he might have a future trading bonds. On Thursday January 8th he predicted that data would show that America had lost more jobs in 2008 than at any time since the second world war. An official report published on Friday confirmed precisely that. Non-farm payrolls plunged by 524,000 in December from November, and the picture was made darker by downward revisions of 154,000 to the previous two months. That brought the loss of jobs since the recession officially began in December 2007 to 2.6m, the largest 12-month drop in absolute terms since the aftermath of the war.

The unemployment rate has jumped from 6.8% to 7.2%, a 16-year high, far above economists’ already dire predictions. It is up from a low of 4.4% in early 2007. Throw in discouraged workers who have given up looking for work and those working part time who would prefer full-time work, and the “under-utilised” employment rate is 13.5%, up from a little over 8% in early 2008.

It is easy to begin fearing that not only will this be the worst recession since the Great Depression, it may be another depression. Yet two reasons exist to temper the pessimism. First, while the magnitude of job loss represents a lot of misery, the American labour force is some two-and-a-half times larger than it was right after the war. The 1.9% drop in employment last year was smaller than the 2.7% 12-month declines recorded at the depths of the 1974-75 and 1981-82 recessions. As a new database from the Federal Reserve Bank of Minneapolis helpfully shows, (see Free Exchange), the percentage decline so far in this recession is exactly equal to the median decline at this stage of the ten post-war recessions.

Whether this remains a median-scale slump depends on what happens next, and the prognosis remains grim. David Greenlaw, an economist at Morgan Stanley, predicts that job losses will continue on the scale of the past few months until around April. “There was a very significant and unusual turn in the economy in September-October when…credit markets were most tight. The consumer stopped buying cars, planned for a weaker Christmas, companies stopped ordering and started looking where they wanted to cut employment…we are in for several more months of this kind of deterioration in overall economic activity.” He sees the unemployment rate reaching 9.5% by the end of the year.

|

|

|

|

|

Another reason to temper pessimism is that the earliest leading indicators, which are in the financial markets, have turned up. Stockmarkets bottomed in November and have since trudged higher, although they fell after Friday’s employment report. Spreads on corporate debt have narrowed since then, and on interbank loans even more so. To be sure, that is in large part thanks to the extension of federal guarantees to much of the financial system, but that demonstrates how rescue measures are getting some traction. Mortgage rates have tumbled on the purchases by the Treasury and the Fed of mortgage-backed securities (MBS), so waves of refinancing, which boosts consumer cash flow, and a rise in home sales, are not far off. “On the margin I’m less bearish on the economic outlook,” says Nancy Lazar, an economist at ISI, an investment group. Her favourite indicator is the broad money supply, which has grown at around a 20% annual rate in the past three months.

Pessimists would note that the Federal Reserve, having cut its short-term interest rate to zero (in effect), is out of conventional ammunition. It is using tools such as open-market purchases of MBS whose stimulative effect is far less certain. But that uncertainty may be symmetric: the impact of these unconventional policy instruments may be larger or smaller than is commonly thought. There is no useful history by which to judge.

|

|

|

|

|

All that said, being less bearish is not the same as bullish. Ms Lazar notes that employment fell for more than two years in the past two cycles, and there is no reason to expect differently this time, even if output stops contracting by the end of this year.

More important, the rally in the financial markets in great part reflects anticipation of aggressive action to be taken by Mr Obama, such as $775 billion in fiscal stimulus, and the Federal Reserve, such as Treasury bond purchases. If they do not deliver, those gains may easily be unwound. “The situation is dire, it is deteriorating, and it demands urgent and dramatic action,” Mr Obama said after the release of Friday’s data. That is not just a political talking point: a gimlet-eyed bond trader would say the same.